XRP Price Prediction: Can It Reach $50 Amid ETF Hype and Pharmacy Adoption?

#XRP

- Technical Strength: Price above 20-day MA and mid-Bollinger Band suggests near-term upside

- Adoption Catalysts: 6,500 pharmacy payments and Uber integration fuel utility demand

- ETF Speculation: Analysts see $20-$50 range possible with regulated investment inflows

XRP Price Prediction

XRP Technical Analysis: Bullish Indicators Emerge

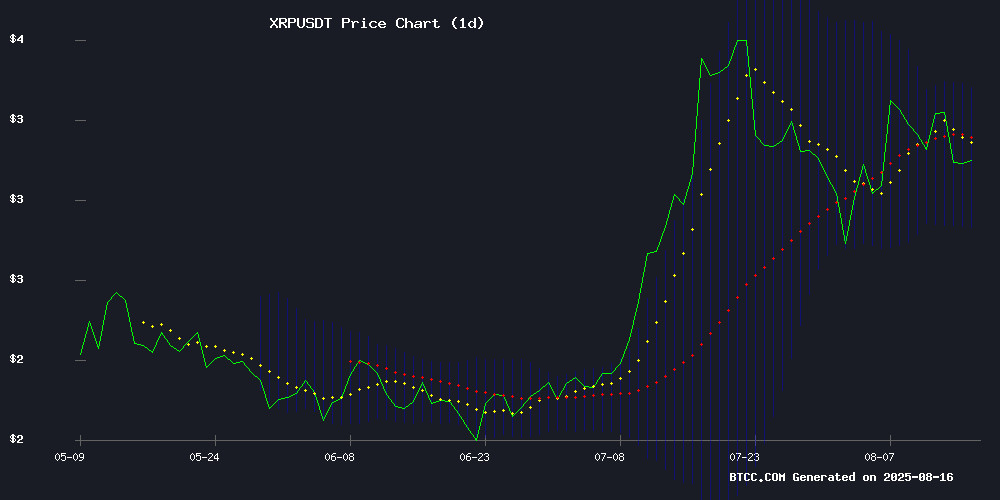

According to BTCC financial analyst Olivia, XRP is currently trading at $3.1228, slightly above its 20-day moving average of $3.1022, indicating a potential bullish trend. The MACD shows a slight bearish crossover (-0.0312 signal vs. 0.0497 MACD), but the price remains within the Bollinger Bands (Upper: $3.3696, Lower: $2.8348), suggesting consolidation before a possible upward breakout.

XRP Market Sentiment: Mixed Signals Amid Adoption and Volatility

BTCC analyst Olivia notes that while XRP faces bearish divergence warnings, its adoption by 6,500 US pharmacies via Wellgistics and bullish ETF speculation ($20-$50 price targets) counterbalance concerns. Whale activity shifting to Remittix and resistance at $4 add short-term uncertainty, but long-term institutional interest (Uber drivers, ETF potential) remains strong.

Factors Influencing XRP’s Price

Wellgistics Enables XRP Payments for 6,500 US Pharmacies

Wellgistics Health, a prescription drug distributor, has introduced a blockchain-based payment system allowing over 6,500 independent U.S. pharmacies to settle transactions using Ripple's XRP Ledger. This initiative marks one of the largest healthcare-sector adoptions of cryptocurrency to date.

The system provides pharmacies with a cost-effective alternative to traditional bank transfers for wholesale drug purchases. Developed in partnership with RxERP, the solution leverages XRP's efficiency for transparent, HIPAA-compliant transactions. "Independent pharmacy owners recognize blockchain's transformative potential," said Wellgistics CEO Brian Norton.

This deployment signals growing institutional acceptance of digital assets in regulated industries. XRP's utility in cross-border payments continues to expand beyond financial services into healthcare logistics.

Gemini Files for Nasdaq IPO Amid Mounting Losses and Regulatory Shift

Gemini, the New York-based cryptocurrency exchange, has taken a decisive step toward becoming a publicly traded entity by filing its S-1 statement for a Nasdaq listing under the ticker GEMI. The move positions Gemini to join the ranks of Coinbase and Bullish as one of the few U.S.-listed crypto exchanges, despite revealing troubling financials for the first half of 2025.

The filing discloses a net loss of $282.5 million, a stark contrast to the $41.4 million loss recorded during the same period in 2024. Adjusted EBITDA tells a similar story, swinging from a $32 million profit to a $113.5 million deficit. These figures cast doubt on the exchange's path to profitability as it seeks public market validation.

Strategic shifts accompany the IPO push. Gemini plans to transition most operations to its Florida-based Moonbase unit, signaling a retreat from New York's stringent regulatory environment. The filing also reveals a $75 million credit facility with Ripple, denominated in the RLUSD stablecoin—a notable partnership in the evolving stablecoin landscape.

Whale Activity Shifts From XRP to Emerging Altcoin Remittix Amid Market Volatility

Ripple's XRP faces downward pressure as large investors reallocate capital to Remittix, a PayFi token drawing comparisons to XRP's early growth trajectory. The altcoin has raised $19.5 million through the sale of 599 million tokens at $0.0944 each.

XRP's price dipped to $3.14 before a partial recovery, remaining 1% lower over 24 hours despite whales acquiring 320 million tokens. The sell-off of $1.9 billion in XRP holdings continues to weigh on the cryptocurrency following its recent legal victory against the SEC.

Market analysts note key support at $3 with resistance forming near $3.25. The whale rotation into Remittix suggests evolving investor preferences in the payments-focused cryptocurrency sector.

Trump-Putin Meeting Sparks Cryptocurrency Market Concerns

Former President Donald Trump's high-profile meeting with Vladimir Putin under the shadow of B2 bombers has sent ripples through the cryptocurrency markets. The Alaska summit's geopolitical implications are being closely watched by digital asset investors, particularly after Trump's history of market-moving statements on international affairs.

XRP Coin faces heightened volatility as tariff rates climb to 16%, with further increases anticipated. The Producer Price Index data reveals early inflationary pressures from these tariffs, triggering accelerated crypto sell-offs. Analyst Martinez's bearish XRP forecast suggests a potential test of $3.26, with $3.9 as the next resistance level, though his pro-XRP bias warrants caution.

China's 41.4% tariff rate and widespread double-digit tariffs across global trade partners are creating macroeconomic headwinds for crypto markets. The geopolitical tension from the Trump-Putin meeting compounds existing concerns, with traders bracing for potential short-term declines across digital assets.

XRP Faces Bearish Divergence as Analysts Warn of Potential Correction

XRP's price slipped 1% to $3.05, erasing recent gains as analysts flag a concerning bearish divergence. The Relative Strength Index (RSI) shows weakening momentum—a pattern last seen in late 2020, preceding a 62-74% collapse.

Critical support lies at $2.90-$3.00. A breakdown could trigger tests of $2.75 or lower. The broader structure mirrors 2021's rally-and-breakdown cycle, suggesting prolonged sideways movement or gradual decline ahead.

Over 6,500 Pharmacies Gain Access to XRP Payment Solution via Wellgistics Health

Wellgistics Health, a leader in pharmaceutical distribution and AI-powered prescription services, has launched its XRP Ledger-powered payment solution. The program brings blockchain-based payments to over 6,500 independent pharmacies and 200 manufacturers across the U.S., enabling instant transactions, reduced fees, and bypassing traditional banking networks.

The integration with RxERP, an eCommerce and ERP system, ensures real-time transaction management, compliance with healthcare regulations, and encrypted payments. Pro-XRP attorney Bill Morgan highlighted the initiative as tangible utility for XRP, noting active onboarding of pharmacies.

Benefits include 24/7 settlement, faster access to working capital, and streamlined inventory restocking. The system eliminates intermediaries, offering a direct, efficient payment alternative for the healthcare sector.

XRP Price Could Surge to $50 Following Spot ETF Approvals, Analysts Predict

Kenny Nguyen, a prominent crypto commentator, projects XRP could rally between $22 and $50 after the debut of spot XRP ETFs—a potential 607% to 1,507% surge. Such a move would catapult XRP's market cap beyond $1 trillion, dwarfing its current $186 billion valuation.

Spot ETFs are poised to unlock institutional demand by offering regulated exposure. Bloomberg analysts now assign a 95% probability to approval, mirroring the trajectory of Bitcoin ETFs earlier this year. "This isn't speculation—it's structural demand meeting constrained supply," Nguyen remarked, drawing parallels to gold's ETF-driven bull market.

At $3.11, XRP remains a high-beta play on regulatory normalization. The SEC's ongoing case against Ripple appears increasingly disconnected from market sentiment, with traders pricing in a favorable resolution. Liquidity patterns suggest accumulation by Asia-based funds anticipating ETF inflows.

Analyst Foresees XRP Surging to $20-$50 Range With Spot ETF Launch

Crypto commentator Kenny Nguyen projects XRP could reach $22 to $50 upon the debut of spot ETFs—a potential 607% to 1,507% gain from current $3.11 levels. Such appreciation would catapult XRP's market capitalization between $1.3 trillion and $3 trillion, dwarfing its current $186 billion valuation.

The forecast hinges on structural advantages distinguishing XRP from assets like Ethereum. Unlike ETH's staking mechanics, XRP imposes no opportunity cost for ETF investors opting for indirect exposure. Canary Capital CEO Steven McClurg emphasizes this differentiation, noting XRP's established payments infrastructure and global community could accelerate institutional adoption through ETF vehicles.

XRP Investment Potential: $300 Monthly Could Yield Significant Returns by 2030

XRP's historical performance suggests substantial growth potential for disciplined investors. A $300 monthly investment, compounded by an annual price increase of 95%, could generate life-changing returns by 2030. The asset has already demonstrated this capability—$100 monthly investments since 2015 would now be worth $3.588 million.

Market analysts argue XRP remains undervalued despite its 200,000% appreciation from initial prices. Vincent Kennedy and other commentators maintain the asset is still in its early adoption phase. Dollar-cost averaging strategies, particularly over decade-long horizons, are gaining traction among crypto advisors like Coach JV.

The projection hinges on XRP mirroring Bitcoin's potential bull runs. While past performance doesn't guarantee future results, the calculations assume sustained 95% yearly growth—an ambitious but not unprecedented target in crypto markets. Exchange platforms like Binance and Coinbase continue seeing steady XRP accumulation from retail investors employing such strategies.

Uber Drivers Signal Mainstream XRP Adoption, Analysts Note

XRP's grassroots adoption is reaching unexpected demographics, with cryptocurrency analysts reporting frequent encounters with Uber drivers actively trading the digital asset. The trend echoes historical "mania signals" observed during major technological shifts, according to industry commentators.

Robert Leshner of Superstate drew parallels to the late 1990s tech boom, while Robot Ventures' Tarun Chitra documented multiple instances of ride-share drivers discussing XRP positions. "Uber drivers know XRP is the one," remarked cryptocurrency influencer Digital Asset Investor, amplifying Chitra's observation.

Attorney John Deaton's Nevada and Michigan Uber experiences further reinforced the narrative—drivers recognized him exclusively for his XRP advocacy during Ripple's SEC litigation. Bloomberg ETF analyst James Seyffart's institutional adoption commentary preceded these anecdotal reports, creating a juxtaposition between retail enthusiasm and professional skepticism.

XRP Price Struggles at $4 Resistance as Remittix Gains Traction

Ripple's XRP faces stiff resistance near the $4 mark despite recent regulatory clarity and institutional interest. The token briefly surpassed $3.20 after its SEC settlement but now hovers at this level as technical barriers between $3.30-$3.40 hold firm. Whale activity shows accumulation—320 million XRP purchased in 72 hours—yet momentum stalls.

Forecasts diverge sharply: conservative estimates suggest $3.12 by August 2025, while bullish Fibonacci projections target $5.53. Market participants increasingly scrutinize utility-driven altcoins like Remittix, which leverages DeFi infrastructure for cross-border solutions, as XRP's adoption narrative wavers.

How High Will XRP Price Go?

Olivia projects a 1-3 month target of $3.50-$4.00 (12-28% upside) based on technicals, with potential for $20+ if spot ETFs are approved. Key levels:

| Scenario | Price Target | Catalyst |

|---|---|---|

| Bearish | $2.83 (Bollinger Lower) | MACD downtrend |

| Base Case | $3.50-$4.00 | MA support + adoption |

| Bullish | $20-$50 | ETF approvals |